3.1High cost performance, low TCO

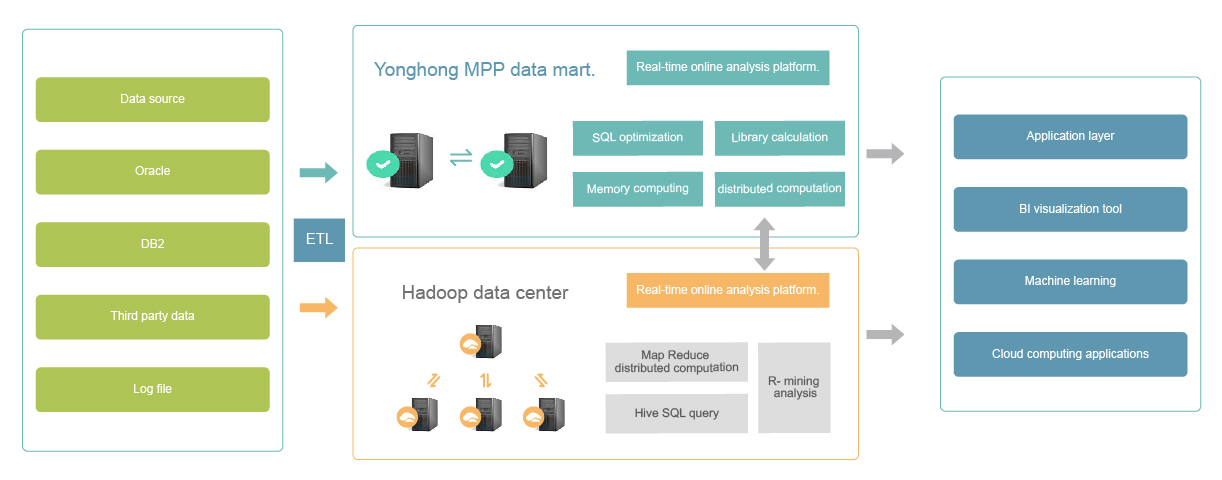

The entire system architecture eliminates the idea of scale-up that is common in traditional systems, whether data mart or BI front end support scale-out. With the growth of corporate business, the demand for data analysis will grow significantly, so that the platform architecture based on X86 PC Server cluster is very critical. Under this architecture, we don't have to purchase expensive minicomputer to support high concurrency to prop up mass data calculation or support data analysis and business development, but buy several ordinary PC Servers to set up clusters and construct highly cost-effective analysis platform.

3.2Agility: Quick release, continuous iteration and embracing change

Data layer agility: the data layer does not need data pre-summary calculation. The traditional architecture requires aggregating data in advance according to all dimensions that can be taken into account as well as the required indexes, or compute in advance by Cube computation method. But the agile BI approach is to simply correlate data, for which imported data are still detailed data, and all calculations happen in real time when the user clicks. Therefore, it is enough for the data layer only to build a lightweight model to import the detailed data newly required.

Application layer agility: with a flexible ROLAP mechanism, SQL will be created in real time for requirement by each click initiated and sent to the computing layer for calculation, which is easier to adapt to business changes.

The number of module levels is small, therefore, report and Dashboard can be directly designed or exploratory analysis can be carried out after modeling completion, which is easier to use for end-users as well.

3.3Self-service and exploratory multidimensional analysis

The mart based on the topic semantically translated the physical table structure into a logical structure that is easy to understand, so that the end-users can self- define report or dashboards at ease by dragging over them.

Interaction and analysis capabilities of front-end system: filtering, drilling, scaling, correlation, transformation, dynamic computing, links, and so on. By identifying the problem, users find the answer and make a business decision, resulting in an exploratory analysis.

3.4 High Availability

Offline and online analysis platforms are in distributed architectures. Data storage is distributed, and data computation is distributed in addition to backup mechanism and monitoring mechanism. When one machine goes down, the other machine automatically assumes all calculations. The analytical computing platform is widely used and still stable and reliable even when the data size of some telecommunication customers reaches hundreds of T. This distributed data mart supports hot plug extensions for computing and storage nodes. It can be extended from one node to dozens or even hundreds of nodes.

3.5High Concurrency

The online analysis platform supports high concurrency. As a computing layer, the data mart supports distributed computation and uses MapReduce architecture to improve computational efficiency. BI front-end can directly connect to Oracle or Hadoop, but it is not recommended to use Oracle or Hadoop to support highly concurrent OLAP system. Because Oracle is stored in a row type, it can support high concurrency in OLTP systems, but fails to support highly concurrent OLAP system; and Hadoop system, as a cost-effective storage system, is not suitable for real-time analysis system. The distributed data mart of Yonghong Tech is stored in the column type by good memory computing technology, which can work in parallel with computing nodes on the basis of multiple storage, very suitable for real-time analysis of mass data.