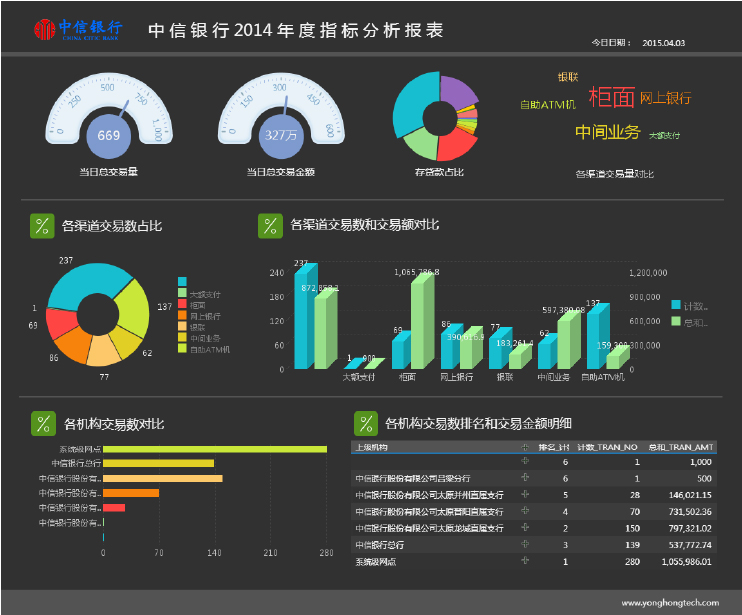

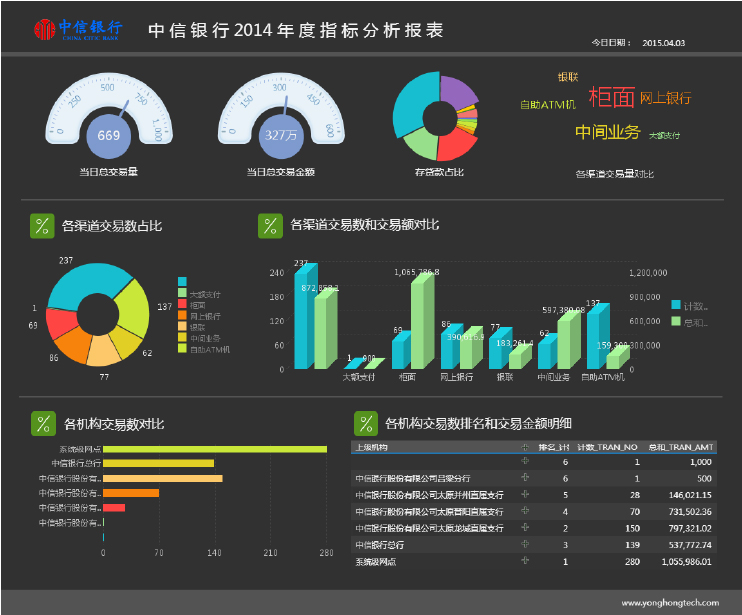

The "cockpit" system helps bank managers to quickly understand operation of bank to improve accuracy and timeliness as a decision-making platform. All the time, CITIC Bank, Sichuan Branch has been expecting to build an overall set of "presidents’ cockpit" system to quickly and easily examine indicators of various institutions. CITIC Bank, Sichuan Branch has wished to know comprehensive business analysis indicators such as wholesale deposit changes. But as it was, although with limited manpower, IT department demanded to launch this project online quickly and leave analysis to business department to manage it by itself through reasonable authority control. Citic bank, Sichuan Branch heavily required for data entry which had to be conducted by the way of batch input or report.

It was not taken into consideration to purchase traditional BI products such as IBM, SAP and Oracle because their cost for several millions RMB was not acceptable to CITIC Bank, Sichuan Branch who was also looking for satisfactory domestic BI products. Unfortunately, most of the domestic BI products in previous generation needed to be modeled before analysis for long online cycle, more seriously, such products were not capable of processing large data volume.

However, after the trial of Yonghong BI products,CITIC Bank, Sichuan Branch has readily resolved its problems. As the leading domestic solution provider for data visualization analysis, Yonghong Tech has core competitiveness in such fields as big data, distributed computation and data analysis, etc., whose independently innovated products have already received a number of invention patents. Basing on the analysis needs issued by the bank, the technical advisers of Yonghong Tech have assisted the bank to sort its business indicators together. In the end, the bank has adopted Yonghong BI, a new generation of BI software of Yonghong Tech, and successfully launched the whole project within a month.

In the past, within limiting time, business personnel required to analyze rankings of customers with excessive specific amount and locate those with abnormal wholesale changes from several reports in direct connection with database belonging to analytical statements on wholesale changes of private clients, and such process needed to be associated with millions and millions of forms. Therefore, larger data volume brought much computational pressure to the server. It would take more than ten minutes to prepare one report. After launching such project online, China CITIC Bank, Sichuan Branch has found that the new system has been sped up through constructing distributed data mart. And response speed of such statements increased up to 10 seconds, 500-600 times faster than ever before.

Yonghong BI is not only even better in performance but also costs a quarter of the cost of traditional BI. What is better known to CITIC Bank, Sichuan Branch is that Yonghong BI is so simple to operate that the system automatically generates the required reports as long as users click on or drag over the analysis indicators for several times, which greatly facilitates business personnel and operational staffs of the bank who don’t have too much technical background to independently complete data analysis, and realizes any requirements by decision makers within one day. Since then, a highly performed system of presidents’ cockpit has been completely set up.

Figure 1: Index Analysis Report of CITIC Bank in 2014